![]() The Eaton Families Association

The Eaton Families Association

By-Laws and Legal Documents

- Copyright Statement

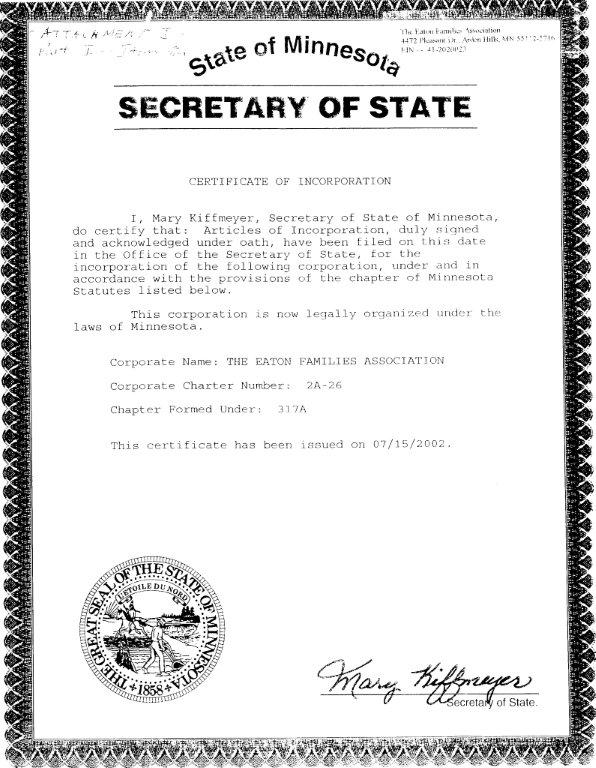

- Certificate of Incorporation

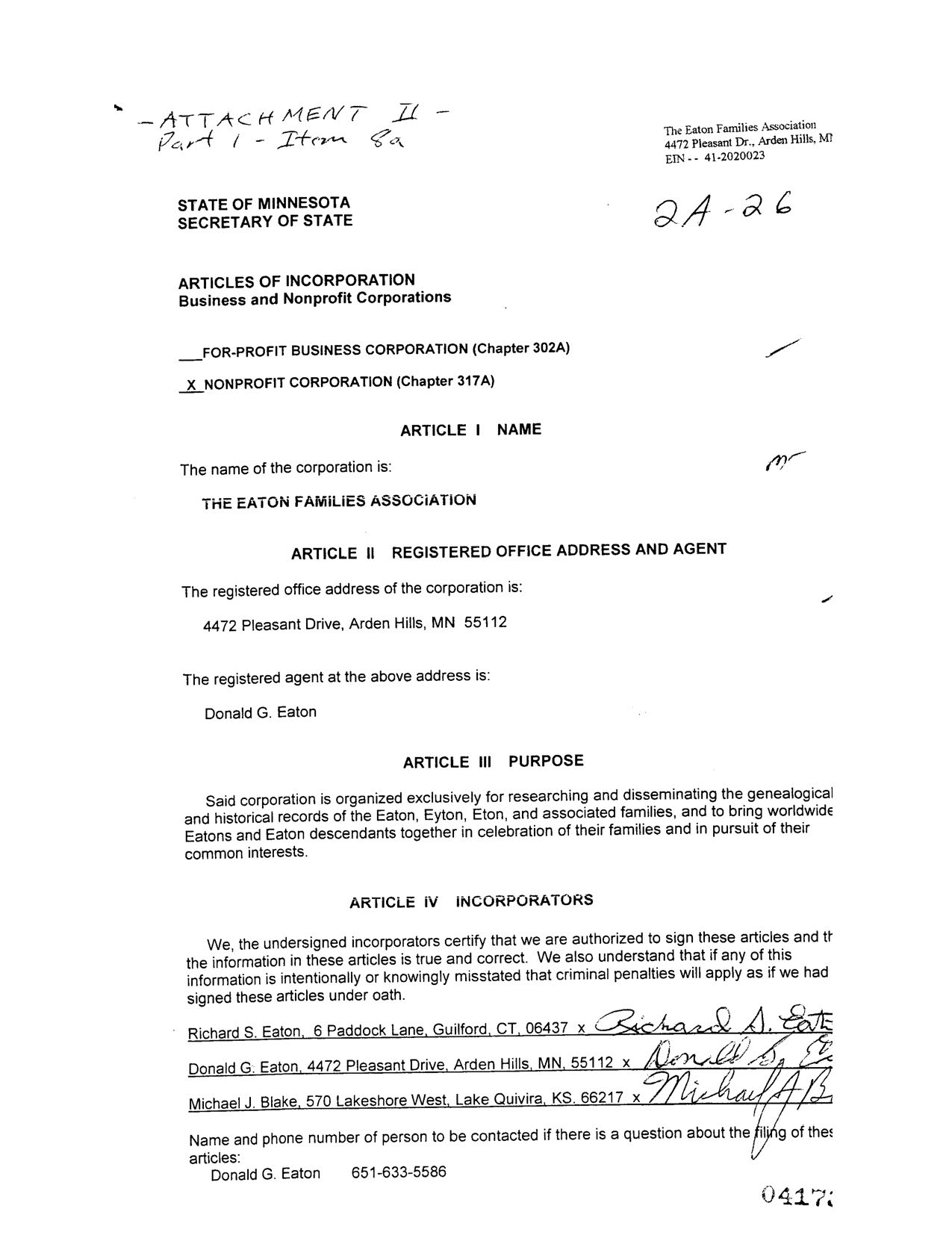

- Articles of Incorporation

- By-Laws

- Exemption Letter from IRS

- Copyright Statement

- Certificate of Incorporation

- Articles of Incorporation

- By-Laws

- Members shall make every effort to contribute to the family spirit of the Association.

- No Member shall conduct himself or herself inappropriately at any Association function or via his or her postings to web site.

- No Member shall act discriminatorily, or in a fashion considered unkindly or impolite, toward another Member, or toward the family or associated family of any other Member.

- In the event of disagreement with another Member or Members, Members shall address their grievances through private communication. Members may, however, bring complaints of violation of these Rules & Regulations to the Executive Committee for review and action.

- No Member shall knowingly file or post false information with the Association. However, the Association shall not reject information from a Member because of disagreement with regard to its factuality. Both Members filing information and Officers receiving it, shall cooperate in the labeling of uncorroborated or undocumented information.

- No Member shall bring discredit to any other Member or to the families.

- Members shall, as they are able, assist other Members in their family research.

- No Member shall engage in activities prohibited by the Association. Members shall, as they deem appropriate, share information and genealogical resources with other Members.

- Exemption Letter from IRS

Unless specifically noted to the contrary or indicated by its original source, all material appearing on http://www.eatongenealogy.com is authored, published and copyrighted by The Eaton Families Association.

Printouts or hardcopies of pages from our site may be created and distributed, if ALL the following requirements are met: (1) The distribution is non-commercial; (2) the distribution is free of charge to the recipients; and (3) the printed pages retain the eatongenealogy.com copyright that is found at the bottom of each page.

Copies may NOT be made for sale, either on microfiche, or on shareware (or similar) collections on CDROM, or for any other commercial purpose whatsoever. Copies may not be added to other online collections either for free, or commercial access without permission. Any references to, or quotations from this material should also give credit to any original author(s) and/or data source. Links to this information from other web pages are welcomed, but please DO NOT copy this information as a whole to your own web site, or submit it for inclusion into other online databases whether free, or commercial. Please ensure any published extracts include a reference to the URL (web page address) of the page you obtained the information. No portion of our site may be reproduced elsewhere on the Internet, including personal genealogy information. Note, however, that individual, specific facts are not copyrightable--you are only prohibited from reproducing large sections of material for which The Eaton Families Association is the author. You may link to any individual web page belonging to this site without restriction by providing the following link to our web site for any material you wish your users to see: http://www.eatongenealogy.com/.

THE EATON FAMILIES ASSOCIATION

BY - LAWS

Article I: Establishment

The Eaton Families Association (hereafter referred to as The Association and formerly known as The Eaton Family Association) was (re)established as a voluntary, not-for-profit organization on November 9, 2001, as recorded by the Minnesota Office of the Secretary of State, St. Paul, Minnesota. A bank account for the deposit of The Association funds was established that date at the Wells Fargo Bank in Arden Hills, Minnesota. The Association is registered with the United States Internal Revenue Service as a 501-(C)(7), tax-exempt, not-for-profit corporation.

The mailing address of the Association, is:

C/O Donald G. Eaton

4472 Pleasant Drive

Arden Hills, MN 55112

The original bylaws were adopted by the incorporators on November 18, 2001, and ratified at the first annual meeting of the membership. They were substantially revised by a majority vote of The Association's Executive Committee on October 13, 2017.

Article II: Purposes

The purposes of The Eaton Families Association are:

To bring worldwide Eatons and Eaton descendants together in celebration of their families and in pursuit of common interests.

To record the genealogies of Eaton and related family lines.

To encourage and support genealogical and historical endeavors related to Eatons and connected families, their origins, ancestry and descendants.

To research, establish, acquire, maintain, preserve, exchange, publish, produce or reproduce records, and (as appropriate or desired) to sell or resell memorabilia, artifacts, historical documents, and other information or goods associated with Eaton and related families.

In support of the above activities, The Association may raise funds, organize family reunions, publish a newsletter and maintain a proprietary website for the benefit of members.

The Association, as deemed appropriate by its Executive Committee, also may join in the support of worthy activities conducted by nonmembers and/or other organizations, provided that such activities are consistent with the above stated purposes and not in conflict with these bylaws.Article III: Officers

The officers of The Eaton Families Association shall consist of President, First Vice President, Secretary, Vice President/Treasurer, Vice President/Web and Newsletter Editor, Membership Chair, and Family Genealogist. They shall be elected biennially at an Annual Meeting.

All officers shall be members of the Executive Committee.

If a vacancy occurs in the office of President, the First Vice President shall become President. In the event of the First Vice President's inability or unwillingness to serve, the Executive Committee shall appoint a President for the unexpired term. In the event of a vacancy in any office, except as set forth for President, the Executive Committee shall fill the vacancy until the next election.

The President shall oversee the overall operation of The Association and its activities. He/She shall chair the Executive Committee and preside over all meetings. He/She shall serve as a co-signatory on the accounts of The Association and, with the Treasurer, on any agreements or contracts into which The Association may enter. Cosigning of contracts may be electronic or by email stating the affirmative and citing the action/contract being signed.

The Executive Committee must approve all financial disbursements in excess of $500.

The First Vice President shall succeed the President upon the latter's inability or unwillingness to serve. He/She shall assist the President in the management of The Association.

The Secretary shall record and distribute to the membership the minutes of all meetings of The Association and will distribute minutes of the Executive Committee actions to all members of the Committee.

The Treasurer shall receive, deposit and pay out the funds of The Association. He/She shall make quarterly financial reports, if requested by the President, and an annual report to the Executive Committee by January 30 following each calendar year. He/She shall maintain detailed and accurate records of the finances of The Association. Upon demand within 30 days, he/she shall make the books of The Association available for inspection by the Executive Committee. The Treasurer may disburse funds up to $500 without a cosigner. In addition, any group of expenditures of $500 in a single week must be approved in writing by the President or, in his/her absence, by a duly recorded vote of the Executive Committee. In order to accommodate electronic payments, the President may substitute cosigning with written authorization for disbursements.

The Treasurer shall maintain one or more online depository accounts to which the President has access for the purposes of review or signature as required by these bylaws. An audit of the books of The Association shall be conducted following the termination of service by the Treasurer, or every five years, whichever is earlier. This provision may be waived by the Executive Committee.

The Vice President/Web and Newsletter Editorshall be responsible for the development and maintenance of The Association's website, including the periodic review and updating of its content. He/She also shall edit and publish The Association's electronic newsletter. He/She may at any time appoint assistant editor(s) or researcher(s).

The Membership Chair shall maintain a record of all members and shall act as recruiter for new members.

The Family Genealogist shall review material submitted for entry to The Association's website to assure its documentation and accuracy and may submit his/her own research as Association research. The Family Genealogist will also assist members with their research and may assist nonmembers with answers to Guest Book queries, but extensive research for nonmembers is not required.

All officers shall report to the Executive Committee.

Article IV: Executive Committee

The Executive Committee shall be composed of the officers of The Association and other members appointed by the President. However, at no time, shall The Executive Committee have more than 12 members.

Whenever any officer vacancy occurs, the Executive Committee shall act to fill the vacancy. Vacancies for At-Large members of the Executive members are appointed by the President.

The Executive Committee may appoint sub-committees and chairs thereof, as it deems necessary to conduct the affairs of The Association.

The Executive Committee, by a majority vote of its membership, may terminate any officer or Executive Committee member shown to be in violation of the bylaws of The Association, or to have, by his or her conduct, brought discredit to The Association.

Article V: Membership

Membership in The Association shall be open to any person who is interested in Eaton and related families and their genealogical background, related history, and heraldry. Members need not bear the Eaton surname.

A member in good standing is one who has completed a membership application, has paid an initiation fee, if required, and whose annual dues and other obligations are paid in full. The one-time initiation fee may be suspended or modified by the Executive Committee at any time. The fee is a onetime non-refundable fee, paid at time of application. Members, who have paid the fee once, and who have suspended membership and then return to active status are exempt from additional initiation fees.

Initiation fees are used to support the website, the research, reunion expenses, archiving and acquisitions of material for the benefit of members.

Membership Categories: Membership categories shall include Charter Members, Annual Members, Student Members, and Members Emeritus. The Executive Committee may create other membership categories it deems appropriate.

Charter and Annual Members: A charter member is any member who paid his/her initiation fee and annual dues on or before July 1, 2002. Anyone who joined The Association subsequent to that date is considered an annual member unless otherwise designated.Membership Year: The membership year for each new member will commence on the first day of the month following the receipt of his/her application, initiation fee (if applicable), and first annual dues payment. Membership renewal will commence on each subsequent anniversary.

Student Member: A student member is any person age 23 or younger who is enrolled full-time in a college or university, or elementary, middle or secondary school. No initiation fee shall be charged to a student member.

Member Emeritus: Anyone who has been a member of The Association for at least two years and who has attained the age of 75, prior to his/her anniversary date, shall be eligible, if he/she chooses, to become a Member Emeritus and is no longer obligated to pay annual dues.

Dues Payment: Except for Members Emeritus for whom there is no such requirement, dues are payable upon application for membership or on the anniversary date. The first day of the month following enrollment constitutes the membership anniversary date.

Establishment of Dues and Fees: The Executive Committee shall establish the amount of dues and any additional fees.

Membership Rights, Benefits and Privileges: All members of The Association are entitled to the rights, benefits and privileges common to all membership categories. These include password-protected access to the website, receipt of the electronic newsletter and discounts on any publications or goods put on sale by The Association. Any member may submit material, such as pedigrees or family trees for publication in the newsletter, subject to the approval of the Editor. If the Editor finds such material unsuitable for either the website or newsletter, the member may appeal to the Executive Committee, who will have the final say.

Right to Vote: All members shall have the right to vote at any general meeting of The Association's full membership.

Membership Responsibilities: : In addition to paying dues on time, members shall abide by the rules and regulations of The Association. Failure to do so may result in termination of membership by act of the Executive Committee.

Article VI: Administration

The Association shall be administered by its officers with the advice and consent of the Executive Committee or, when applicable, according to the dictates of its members as expressed by voting at general meetings.

Annual Meetings: The Association shall hold annual meetings of its members. These meetings may be held over the internet and shall be conducted according to Roberts Rules of Order.

Generation and Use of Funds: The Association may fund itself through its initiation fee, dues, gifts and other ways and means.

In the event that The Association has an excess of unexpended revenue, the excess shall be deposited in an interest-bearing account at a federally insured bank or credit union, or in a guaranteed investment account, chosen by the Treasurer and approved by the Executive Committee. The Association shall maintain, when possible, reserve funds against unforeseen circumstances and future needs.

The Association may establish additional ways and means for raising funds, including (but not limited to) the establishment of an online shop and the organization of events, activities and programs related to the purposes of the organization.

No funds of The Association shall be paid to any member or officer except as reimbursement for customary and usual out-of-pocket expenses associated with the conduct of their duties, or except as compensation for extraordinary services rendered (or goods provided) as approved by the Executive Committee. However, in the event The Association requires services or goods, members shall have preference as vendors and service providers. Also, however, the Executive Committee, in the event of the establishment of an online shop, shall be able to appoint and compensate a shopkeeper who may or may not be a member of The Association. The shopkeeper, if any, shall report to the Vice President/Web and Newsletter Editor.

Non-Liability of Officers and Executive Committee Members: Neither Officers nor members of the Executive Committee shall be liable for the debts or other liabilities for The Association. They shall be indemnified by The Association to the fullest extent possible under the laws of the state in which The Association is incorporated and any country in which it operates and/or Members reside.

Business Relationships: The Association, with the approval of the Executive Committee, may enter into Agreements and Contracts with individuals and/or other organizations. Agreements and contracts approved must be signed by both the President and the Treasurer. No Agreement or Contract shall be binding upon The Association unless so approved and signed. Officers and others who have negotiated agreements, contracts and other potentially binding documents, shall bring them to the Executive Committee for approval and to the President and Treasurer for their signatures.

This is a 501 (c) (7) Corporation.

Limitation of Activities: No substantial part of the activities of The Association shall be the carrying on of propaganda, or otherwise attempting to influence legislation, and The Association shall not participate in, or intervene in, any political campaign on behalf of, or in opposition to, any candidate for public office.

Notwithstanding any other provisions of these By-Laws, this Corporation shall not carry on any activities not permitted to be carried on (a) by a corporation exempt from federal income tax under Section 501 (c) (3) of the Internal Revenue Code, or (b) by a corporation, contributions to which are deductible under Section 170 (c) (2) of the Internal Revenue Code.

Prohibition against Private Inurement: No part of the net earnings of The Association, its assets remaining after payment, or provision for payment, of all debts and liabilities of The Association shall be distributed for one or more exempt purposes within the meaning of Section 501 (c) (3) of the U.S. Internal Revenue Code or shall be distributed to any government for a public purpose. Such distribution shall be made in accordance with all applicable provisions of law.

Dissolution: Upon the dissolution of The Association, the Executive Committee shall, after paying or making provision for the payment of all of the liabilities, dispose of all of the assets in such a manner, or to such organization or organizations organized and operated exclusively for charitable or education purposes as shall at the time qualify as an exempt organization under Section 501 (c)(3) of the Internal Revenue Code of 1954 (or the corresponding provision of any future United States Internal Revenue Law), as Committee shall determine.

Article VII: Amendment of By-Laws

These By-Laws, and the Rules and Regulations incorporated herein, may be altered, amended or repealed, with new By-Laws substituted, by a majority vote of the Executive Committee.

Article VIII: Rules & Regulations:

The Rules & Regulations may be amended without notice by the Executive Committee.

* * *

(Revised October, 2017)

DEPARTMENT OF THE TREASURY

INTERNAL REVENUE SERVICE

P.O. BOX 2508

CINCINNATI, OH 45201

Employer Identification Number: 41-2020023

DLN: 17053283041022

THE EATON FAMILIES ASSOCIATION

C/O DONALD G EATON

1472 PLEASANT DR

ARDEN HILLS, MN 55112-5716

Contact Person: PATRICE WHANG ID# 95083

Contact Telephone Number: (877) 829 - 5500

Internal Revenue Code Section 501 (c) (07)

Accounting Period Ending: October 31

Form 990 Required: Yes

Addendum Applies: Yes

Dear Applicant:

Based on information supplied, and assuming your operations will be as stated in your application for recognition of exemption, we have determined you are exempt from Federal income tax under section 501(a) of the Internal Revenue Code as an organization described in the section indicated above.

Unless specifically excepted, you are liable for taxes under the Federal Insurance Contributions Act (social security taxes) for each employee to whom you pay $100 or more during a calendar year. And, unless excepted, you are also liable for tax under the Federal Unemployment Tax Act for each employee to whom you pay $50 or more during a calendar quarter if, during the current or preceding calendar year, you had one or more employees at any time in each of 20 calendar weeks or you paid wages of $1,500 or more in any calendar quarter. If you have any questions about excise, employment, or other Federal taxes, please address them to this office.

If your sources of support, or your purposes, character, or method of operation change, please let us know so we can consider the effect of the change on your exempt status. In the case of an amendment to your organizational document or bylaws, please send us a copy of the amended document or bylaws. Also, you should inform us of all changes in your name or address.

In the heading of this letter we have indicated whether you must file Form 990, Return of Organization Exempt From Income Tax. If Yes is indicated, you are required to file Form 990 only if your gross receipts each year are normally more than $25,000. However, if you receive a Form 990 package in the mail, please file the return even if you do not exceed the gross receipts test. If you are not required to file, simply attach the label provided, check the box in the heading to indicate that your annual gross receipts are normally $25,000 or less, and sign the return.

If a return is required, it must be filed by the 15th day of the fifth month after the end of your annual accounting period. A penalty of $20 a day is charged when a return is filed late, unless there is reasonable cause for the delay. However, the maximum penalty charged cannot exceed $10,000 or 5 percent of your gross receipts for the year, whichever is less. For organizations with gross receipts exceeding $1,000,000 in any year, the penalty is $100 per day per return, unless there is reasonable cause for the delay. The maximum penalty for an organization with gross receipts exceeding $1,000,000 shall not exceed $50,000. This penalty may also be charged if a return is not complete, so please be sure your return is complete before you file it.

You are not required to file Federal income tax returns unless you are subject to the tax on unrelated business income under section 511 of the Code. If you are subject to this tax, you must file an income tax return on Form 990-T, Exempt Organization Business Income Tax Return. In this letter we are not determining whether any of your present or proposed activities are unrelated trade or business as defined in section 513 of the Code.

You are required to make your annual information return, Form 990 or Form 990-EZ, available for public inspection for three years after the later of the due date of the return or the date the return is filed. You are also required to make available for public inspection your exemption application, any supporting documents, and your exemption letter. Copies of these documents are also required to be provided to any individual upon written or person request without charge other than reasonable fees for copying and postage. You many fulfill this requirement by placing these documents on the Internet. Penalties may be imposed for failure to comply with these requirements. Additional information is available in Publication 557, Tax-Exempt Status for Your Organization, or you may call our toll free number shown above.

You need an employer identification number even if you have no employee. If an employer identification number was not entered on your application, a number will be assigned to you and you will be advised of it. Please use that number on all returns you file and in all correspondence with the Internal Revenue Service.

A section 501(c)(7) organization is permitted to receive up to 35 percent of its gross receipts, including investment income, from sources outside of membership without losing its tax-exempt status. Of the 35 percent, not more than 15 percent of the gross receipts may be derived from the use of the club facilities or services by the general public. Income in excess of these limits may jeopardize your continued tax-exempt status.

Donors may not deduct contributions to you because you are not an organization described in action 170© of the Code. Under section 6113, any fund-raising solicitation you make must include an express statement (in a conspicuous and easily recognizable format) that contributions or gifts to you are not deductible as charitable contributions for Federal income tax purposes. This provision does not apply, however, if your annual gross receipts are normally $100,000 or less, or if your solicitations are made to no more than ten persons during a calendar year. The law provides penalties for failure to comply with this requirement, unless failure is due to reasonable cause.

If we have indicated in the heading of this letter that an addendum applies, the enclosed addendum is in integral part of this letter.

Because this letter could help resolve any questions about your exempt status, you should keep it in your permanent records.

If you have any questions, please contact the person whose name and telephone number are shown in the heading of this letter.

Sincerely yours,

Lois G.Lerner

Director, Exempt Organizations

THE EATON FAMILIES ASSOCIATION

This determination letter is effective from July 15, 2002, the date your organization was incorporated.